FTC REQUIRES "CLICK to CANCEL" Online Subscriptions!

The Federal Trade Commission just rolled out some new rules, and if you’re a subscription-based business (or a subscriber), you’ll want to hear this.

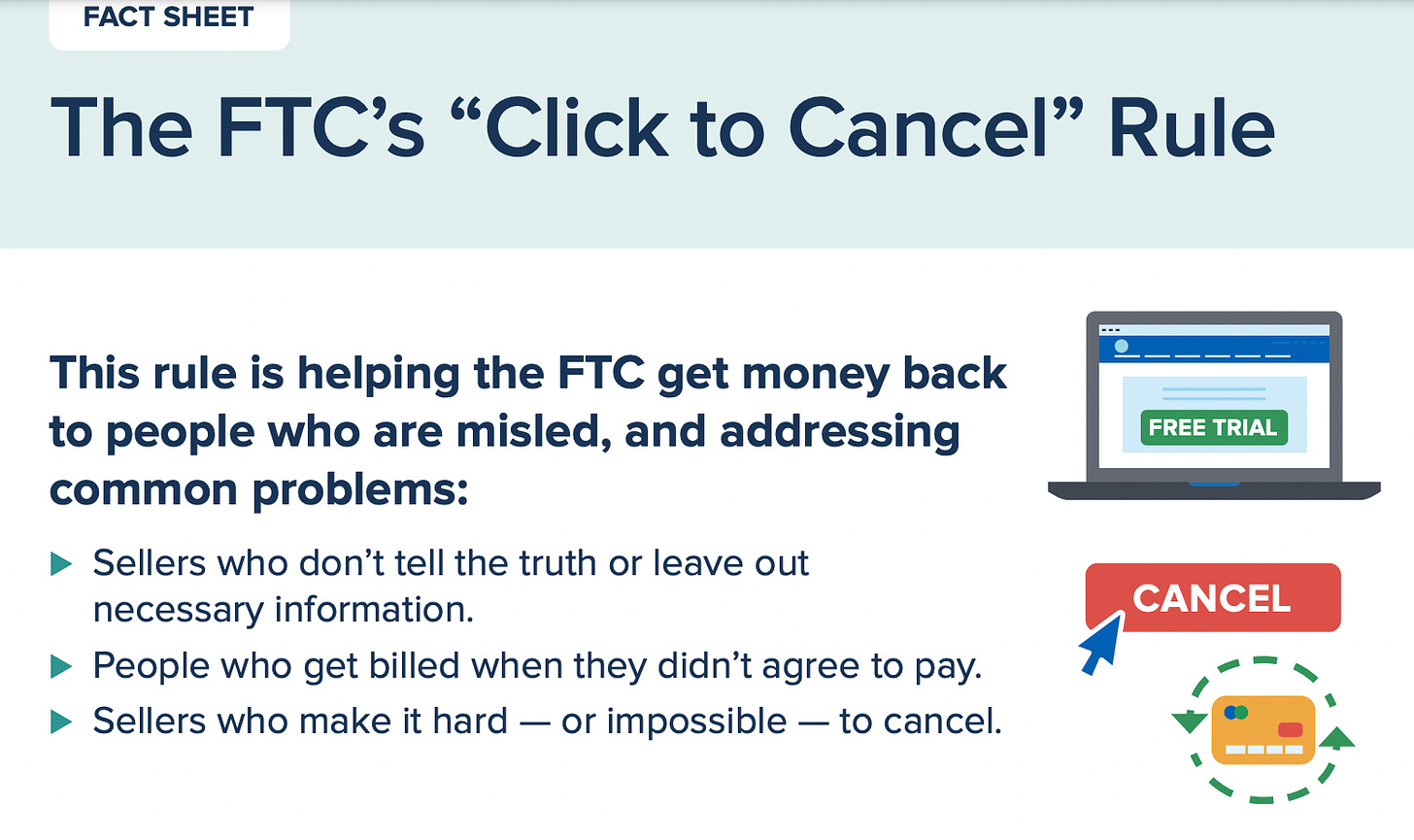

The Federal Trade Commission (FTC) just rolled out a new rule called the "Click-to-Cancel" rule, which is designed to make it much easier for consumers to cancel recurring subscriptions or memberships. In simple terms, companies and sellers can no longer make you jump through a bunch of hoops to cancel something you've signed up for.

As of October 16th, the "Click to Cancel" rule is officially here, making it as easy to cancel a service as it was to sign up. Most of these rules kick in 180 days after they’re published in the Federal Register—so the countdown has begun for websites and services to stop playing hide-and-seek with their cancellation options.

Side note: All I use is Stripe and Substack so when you subscribe to my content, your payment takes a little detour: first, it goes to Substack, then Stripe swoops in, and they both take their cuts. That’s why I love when people support me directly with cash or check—no third-party cuts! If you don’t have a penny to spare, please don’t spend a penny. Your support means the world to me, whether it’s financial or just being here and engaging with the channel. And if you do feel called to support with a paid subscription, I’m truly grateful for each and every one of you who helps keep this ship afloat.

FTC Chairwoman Lina Khan is fed up with companies making consumers go through unnecessary steps just to cancel subscriptions, explaining, "The FTC’s rule will end these tricks and traps, saving Americans time and money. Nobody should be stuck paying for a service they no longer want." And I’m right there with her.

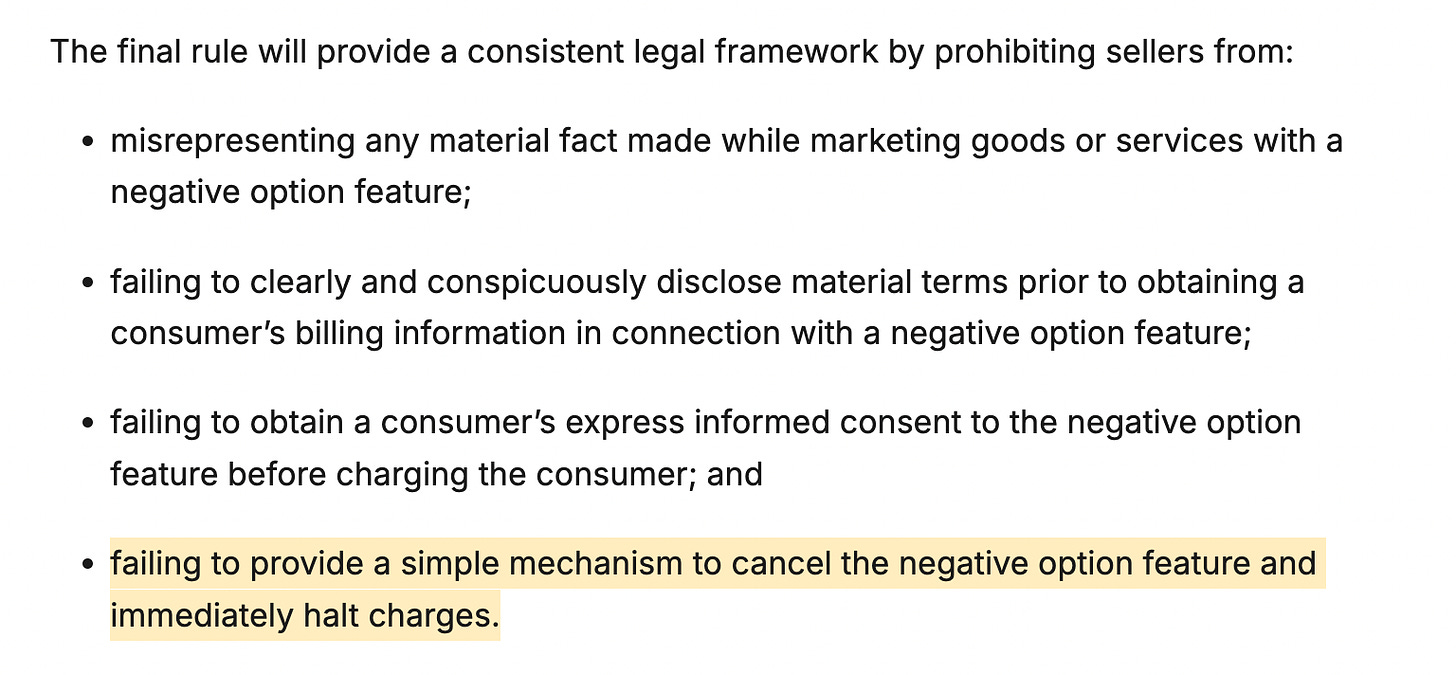

The new rule is meant to end those shady practices where businesses rely on “negative option features”—you know, the ones where you sign up once and then have to Houdini your way out later. They can no longer hide the details of what you’re signing up for, and they must get your “informed consent” to these negative option features before charging you.

And a round of applause for this one: if you don’t make it easy to cancel and stop the charges, it’s now officially illegal. Finally! No more customer service black holes where you have to send up a flare just to reach a human being.

FTC Fact Sheet on “Click to Cancel” Rule

The FTC reported, “while negative option marketing programs can be convenient for sellers and consumers, the FTC receives thousands of complaints about negative option and recurring subscription practices each year. The number of complaints has been steadily increasing over the past five years and in 2024 the Commission received nearly 70 consumer complaints per day on average, up from 42 per day in 2021.”

This is where taking action comes in. Filing those complaints? It might feel like shouting into the void at times, but it’s not wasted energy. Each complaint sets a pattern, and that pattern builds momentum. It may take time, but it makes a difference. This steady push is why we’re seeing changes like the new FTC rule.

Look at what’s happening with employment, the EEOC, and religious discrimination—people are filing complaints and seeing change. Our efforts with the FBI about Andrew Do’s corruption? Now he’s under investigation. We’ve helped countless people secure religious exemptions from colleges and employers, we stopped the OC vaccine passport program in its tracks. Those ridiculous “wash your hands, stay home, save lives” highway signs? We got rid of those in the early days, too. These wins aren’t coincidences—they’re happening because we took action… and there is strength in numbers.

When we take action, regardless of the immediate result, we’re contributing to a larger movement for change. So while this is not news related to the cooties hogwash, I do want to make the connection that our voices matter, and staying silent only helps the problem persist. So, take action, speak up, and know that it counts—even if it takes a while to see the impact.

The new FTC rule does apply to emailed newsletters as well. If a newsletter operates on a subscription model, the same rules apply: it must be just as easy to cancel as it was to sign up. This means you should be able to unsubscribe from an emailed newsletter with a simple, one-click option. The rule isn't limited to paid services—it’s all about transparency and making sure consumers can easily opt out, regardless of the type of subscription.

I don’t send out newsletters these days, but I do use Substack, and it has this feature.

A quick note about emails: I’m incredibly grateful for all the emails I receive from you. While I can’t possibly answer every single one, I do my best to respond to comments on the videos within the first 24 hours. If you want to get my attention and have your question answered, becoming a financial partner is the best way to go. Join our monthly webinars, where I make it a point to answer every single question during the Q&A sessions. Those who support my work at The Healthy American get top priority.

I've likely addressed most common questions in my videos over the years, which you can easily find organized in playlists on my channel. For medical rights questions, check the “Medical Rights” playlist; for exemptions, look under “Exemptions.” It’s just not feasible for us to respond to every email, especially since it’s just me and Olivia here handling the support.

I rarely get to reply to emails with links to articles or videos unless I catch them in the moment. The urgent matters we prioritize include billing or subscription problems, and anything directly related to a product or service you’ve invested in. Those customer service emails are answered within 24 hours, unless they somehow get lost in spam.

Thank you all for your comments and support!

We’ll see. I appreciate the encouragement of voicing one’s thoughts, but these are the same three letter folks who gave us the (worthless) “Do Not Call” registry. I’m betting they’ll screw it up one way or another, and the scrupulous will find a work-around. I’m envisioning a “click to cancel subscription” right on a homepage - white text on a white background. :(

Then again, what are the "unintended consequences" which are so hard to see at present?

Time will tell.